Get Ahead of Your Profits Tax Return with These Time-Saving Dates

Annual filing the Profits Tax return is one of the taxation obligations for limited companies in Hong Kong.

You know that doing your startup or freelance after registration of your limited company in Hong Kong can bring a range of benefits compared to that of your sole proprietorship; however, with the fundamental character as a separate legal person from the owners and managers of the company, your company has to comply with the taxation and audited accounting obligations. Thus you need to bear the cost of corporate accounting services and statutory audited account services for your company.

Although you cannot ditch these duties, you can cut your cost on these by allowing more time for your accountants and auditors to prepare for the books every accounting year.

Here we are going clear the way for you to follow by a few explanations of when you need to file the Profits Tax return for your Hong Kong company.

Accounting Year v.s. Fiscal Year

In the terminology of Hong Kong taxation, the accounting year is a period for the corporate taxpayer to report their accounting books covering this timeframe.

You are free to choose any calendar date (FYI, calendar date or lunar calendar date is accepted) as the end date of your company’s accounting year on your tax return; however, the accounting year must not shorter than 6 months or longer than 15 months.

In view of the Hong Kong Inland Revenue Department (IRD, tax authority of Hong Kong), the end date of your accounting year matters, as it defines when the due date of your Profits Tax return (we will cover it in the next section), so the end date is also called Accounting Date, in shorthand.

On the other hand, the term “fiscal year” refers to the financial year of the Hong Kong Government, which is fixed to start on 1 April every year and ends on 31 March of the following year. For fiscal year 2022/23, the start date is 1 April 2022, and the end date is 31 March 2023.

You can tell why the IRD sends out the Profits Tax return (Profits Tax is the taxation for businesses) to every company at the beginning of April every year. April marks the new start of the fiscal year, so it is legal for the IRD to demand the tax on your corporate income accountable up to the prior accounting date of your company.

Accounting Date v.s. Due Date of Profits Tax Return

Accounting Date is flexible to every corporate taxpayer. You can declare your date on the FIRST tax return which you should receive it within 18 months after the date of incorporation, or precisely speaking, the date of commencement of business. By the way, the IRD has adopted this flexible approach to take care of the new business, so that the new company generally have passed their first accounting year before they need to file the first tax return.

On every Profits Tax return, the IRD writes that the recipients have to file the return no later than one month from its issuance date, namely the “normal due date”.

As you can guess, it is too short for some taxpayers who have selected their accounting date as 31 March.

The IRD allows taxpayers to apply for the pre-determined extension based on their accounting date.

Block Extension Scheme for Lodgement of 2022/23 Profits Tax Returns

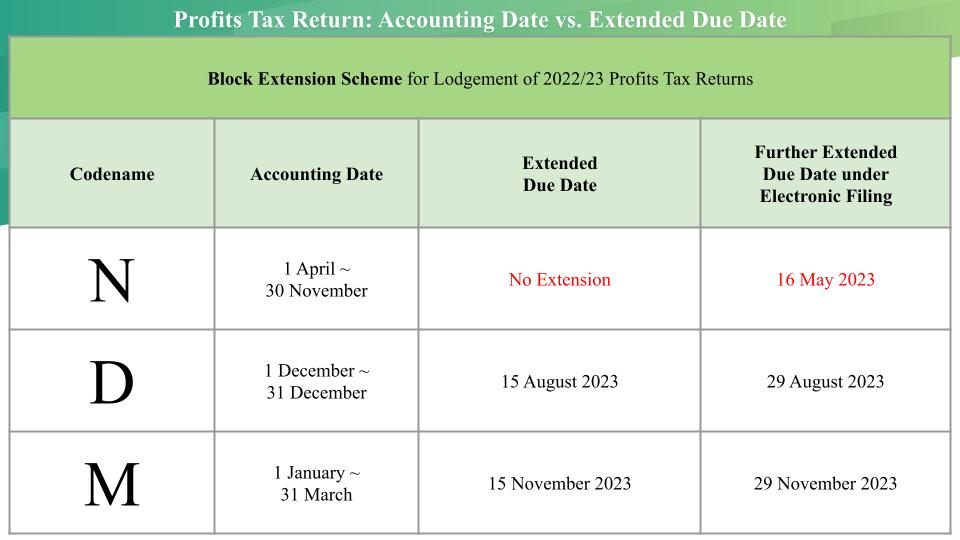

Under the first and second column “Code” and “Accounting Date”, you should see that the IRD has grouped and codenamed all taxpayers into four categories, according to their self-selected Accounting Date.

Then, from the second column “Extend Due Date”, you can find the standardized extension of due date for each group under the IRD’s Block Extension Scheme; however, the taxpayers have to apply for this before their normal due date.

Finally, the last column “Electronic Filing Extended Due Date” means that if the taxpayers submit their returns via the IRD’s electronic filing online portal, they can automatically enjoy the further extension of around 2 weeks. This “2-week extension” is given to all taxpayers if they use this online submission service, no matter they have applied for the Scheme.

How to make the best use of the Accounting Date?

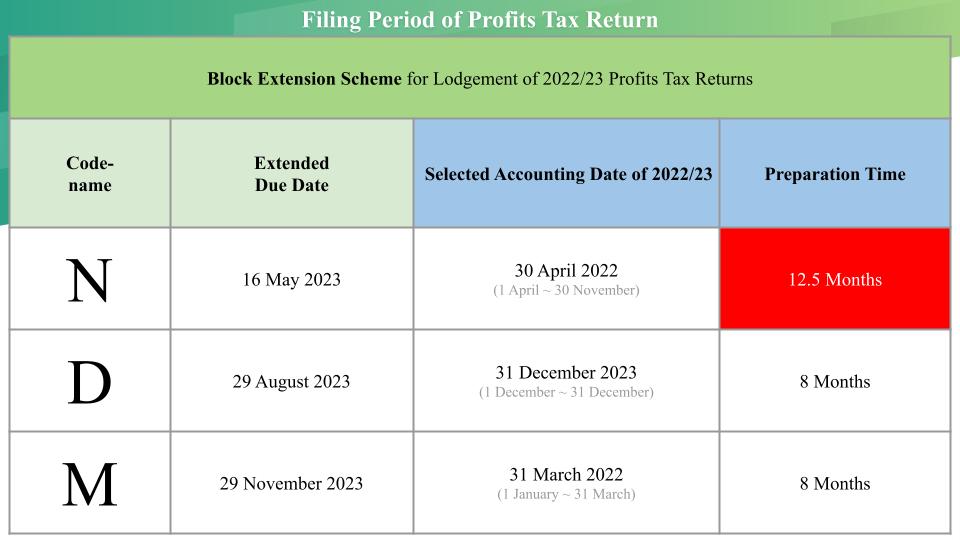

At first glance, you may feel uncomfortable that the “N Code” group, the IRD refuses to make “Block Extension”. Does the IRD dislike you when you choose your Accounting Date between 1 April to 30 November?

Surprisingly, the IRD is encouraging you to take this period.

The “N code” Profits Tax returns give upto 12.5 months to your Hong Kong company to handle the taxation and accounting obligations.

Let’s make an insight here. Assume that your continuing business has the accounting date as 30 April (thus “N code” tax return), you have received the tax return on 4 April 2023. Do you know which accounting year of your company you need to file on the return? It is the accounting year 2021/2022 of your company! It is because this accounting year ended on 30 April 2022 – covering the period from 1 May 2021 to 30 April 2022. You have 12.5 months to get yourself ready to the tax return.

In contrast, if the same business has the accounting date as 31 December (“D code”), the extended due date of return will be by the end of August, leaving eight months to you.

From the example above, you can make a comfortable timetable to comply with your taxation and accounting obligations by choosing the “N code” return. Plus, you do not put effort to apply for the “Block Extension Scheme”.

Leverage your corporate accounting and taxation workload!

AsiaBC offers full-fledge and flexible services in the accounting and taxation field for Hong Kong small-to-medium enterprises which are doing offshore and international businesses. Check out our outsourcing tax representative service and on-demand accounting service.

![Asia Business Centre (Asia Business Centre (AsiaBC) [HK+SG Bank Account Opening / Company Formation / Company Secretary / Accounting & Tax])](https://asiabc.com.hk/wp-content/uploads/Blog-Banner-Get-Ahead-of-Your-Profits-Tax-Return-with-These-Time-Saving-Dates-1030x464.png)

![Asia Business Centre (Asia Business Centre (AsiaBC) [HK+SG Bank Account Opening / Company Formation / Company Secretary / Accounting & Tax])](https://asiabc.com.hk/wp-content/uploads/Blog-Banner-3-Upsides-When-Freelancers-Start-Their-Own-Company-Right-Now-80x80.png)

![Asia Business Centre (Asia Business Centre (AsiaBC) [HK+SG Bank Account Opening / Company Formation / Company Secretary / Accounting & Tax])](https://asiabc.com.hk/wp-content/uploads/Blog-Banner-3-Best-Ways-HK-Startups-Claim-Tax-Deductions-80x80.png)