FinTech Frontier : Top 7 Digital Banking Choices vs. Traditional Banks

Contributed by AsiaBC | 01 Nov 2024

Scaling Globally? Why FinTech is Your Smart Move

Are traditional banks slowing your global expansion? The lengthy and complex process to set up a bank account can be a major roadblock for ventures entering foreign markets. But with the rise of FinTech, businesses now have faster, more efficient alternatives. In this article, we explore leading FinTech solutions – Airwallex, WorldFirst, Aspire, Payoneer, Currenxie, RD Technologies, and Statrys – and how they can streamline your international transactions.

For many SMEs and digital entrepreneurs, cross-border banking remains a significant challenge. Traditional banks often require in-person verification and lengthy approval processes, which slows down scalability. Fortunately, Hong Kong’s FinTech sector continues to evolve and now provides seamless digital banking solutions that eliminate the need for local procedures.

Your Guide to the Best FinTech Partner

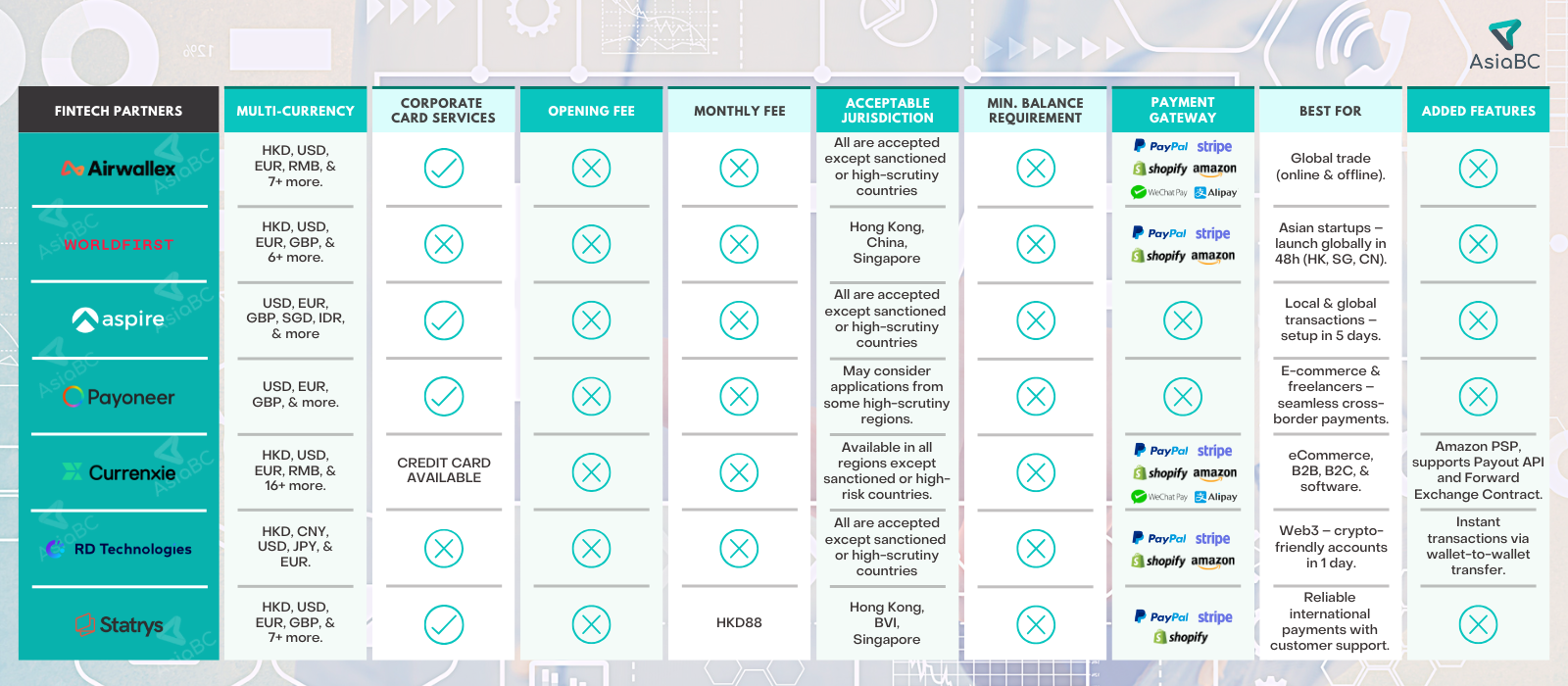

Choosing the right FinTech partner can be overwhelming, with a wealth of digital banking options available. To simplify your decision, we’ve outlined the core benefits of the leading FinTech platforms so you can identify the best fit for your business.

Here’s a detailed comparison that highlights the strengths of Airwallex, WorldFirst, Aspire, Payoneer, Currenxie, RD Technologies, and Statrys, and explains how these alternative conventional corporate accounts support your business growth.

Airwallex

- Multi-currency: Supports HKD, USD, EUR, RMB, and 7+ more.

- Corporate card services: Available.

- No opening fees, monthly fees, or minimum balance requirement, but a transaction fee applies for amounts below US$250

- Acceptable jurisdictions : Available to all except sanctioned or high-risk countries.

- Payment marketplaces : Compatible with PayPal, Stripe, Amazon, Shopify, WeChat Pay, and Alipay.

- Best for : Businesses engaging in global trade, both online and offline.

WorldFirst

- Multi-currency : Supports HKD, USD, EUR, GBP, and 6+ more.

- Corporate card services : Not available.

- No opening fees, monthly fees, or minimum balance requirement.

- Payment marketplaces : Compatible with PayPal, Stripe, Amazon, and Shopify.

- Best for : Asian startups and entrepreneurs looking for a seamless digital alternative to launch global commerce from Hong Kong, Singapore, or China, with fast business or e-commerce account setup within 48 hours.

Aspire

- Multi-currency : Supports USD, EUR, GBP, SGD, IDR, and more.

- Corporate card services : Available.

- No opening fees, monthly fees, or minimum balance requirement.

- Acceptable jurisdictions : All accepted except sanctioned or high-scrutiny countries.

- Best for : Businesses needing an all-in-one, efficient solution for local and global transactions, with a fast setup – typically within five working days – even if additional documents are required.

Payoneer

- Multi-currency : Enables free payments in USD, EUR, GBP, and more.

- Corporate card services : Available.

- No opening fees, monthly fees, or minimum balance requirement.

- Acceptable jurisdictions : May consider applications from some high-scrutiny regions.

- Best for : E-commerce sellers, businesses, and freelancers needing a seamless cross-border payment solution for efficient international transactions.

Currenxie

- Multi-currency : Supports HKD, USD, EUR, RMB, and 16+ more.

- Corporate card services : Credit card available.

- No opening fees, monthly fees, or minimum balance requirement.

- Acceptable jurisdictions : Available in all regions except sanctioned or high-risk countries.

- Payment marketplaces : Compatible with PayPal, Stripe, Amazon, Shopify, WeChat Pay, and Alipay.

- Best for : Businesses selling goods and services – eCommerce, B2B, B2C, and software – while offering fast domestic account setup in the EU, UK, US, CA, and AU, typically within three days.

- Added features : Approved Amazon PSP, supports Payout API and Forward Exchange Contract (FEC).

RD Technologies

- Multi-currency : Supports HKD, CNY, USD, JPY, and EUR.

- Corporate card services : Not available.

- No opening or monthly fees.

- Acceptable jurisdictions : All are accepted except sanctioned or high-scrutiny countries.

- Payment marketplaces : Compatible with PayPal, Stripe, Amazon, and Shopify.

- Best for : Web3 businesses seeking a crypto-friendly solution with seamless account setup – completed within one business day.

- Added features : Instant transactions via wallet-to-wallet transfer.

Statrys

- Multi-currency : Supports HKD, USD, EUR, GBP, and 7+ more.

- Corporate card services : Available.

- Transparent pricing : No minimum balance requirement, no opening fee (except for special cases), and a fixed HKD 88 monthly fee with unlimited incoming payments and no transaction limits.

- Acceptable jurisdictions : Available for Hong Kong, Singapore, and BVI companies with minimal documentation – only a Business Registration certificate and director’s passport required (additional documents may be needed in some cases).

- Payment marketplaces : Compatible with PayPal, Stripe, and Shopify.

- Best for : Businesses needing reliable international payments with dedicated customer support.

How AsiaBC Finds the Right Digital Banking Alternative

Traditional banking has long been the default for global transactions, but FinTech solutions are revolutionising how businesses manage finances. With faster account setup, lower fees, and seamless cross-border payments, these platforms offer a more agile, cost-effective, and scalable alternative to conventional banking.

At AsiaBC, we understand that selecting the right financial partner is critical for entrepreneurs looking to expand globally. Whether you need a multi-currency account or a solution tailored to your industry, we help you navigate FinTech options that align with your business needs.

Let’s optimise your financial strategy. Connect with our experts at business@asiabc.com.hk and unlock seamless international transactions.

![Asia Business Centre (Asia Business Centre (AsiaBC) [HK+SG Bank Account Opening / Company Formation / Company Secretary / Accounting & Tax])](https://asiabc.com.hk/wp-content/uploads/Blog-Thumbnail-Tap-Into-Local-Expertise-5-Reasons-Why-Your-HK-Venture-Needs-a-Company-Secretary-80x80.png)

![Asia Business Centre (Asia Business Centre (AsiaBC) [HK+SG Bank Account Opening / Company Formation / Company Secretary / Accounting & Tax])](https://asiabc.com.hk/wp-content/uploads/Blog-Thumbnail-Dont-Get-Caught-Meet-IRDs-New-Tax-Rules-for-Dormant-Companies-in-Hong-Kong-80x80.png)